Hitta din plats för etablering

MARK FÖR

VERKSAMHETSETABLERING

Letar du efter en plats att etablera dig på i Skaraborg? Vi har mark redo! I Skaraborg finns du mitt ibland Sveriges och Nordens stora marknader med utmärkta logistikmöjligheter och modern infrastruktur. Marken vi förmedlar är kommunalt ägd större verksamhetsmark som är redo att bebyggas med framtidens industrier. Hos respektive kommun går det även att söka lediga verksamhetslokaler, mindre och privat ägd verksamhetsmark.

Sök och filtrera

Välj kommun

Hos respektive kommun går det även att söka lediga verksamhetslokaler och privat ägd verksamhetsmark.

Yta (m²)

Bygghöjd (m)

Typ av verksamhet

Filtrera sökresultat

Sök och filtrera

Välj kommun

Hos respektive kommun går det även att söka lediga lokaler och bebyggd verksamhetsmark.

Yta (m²)

Bygghöjd (m)

Typ av verksamhet

Munkagården

Denna site är lämpad för:

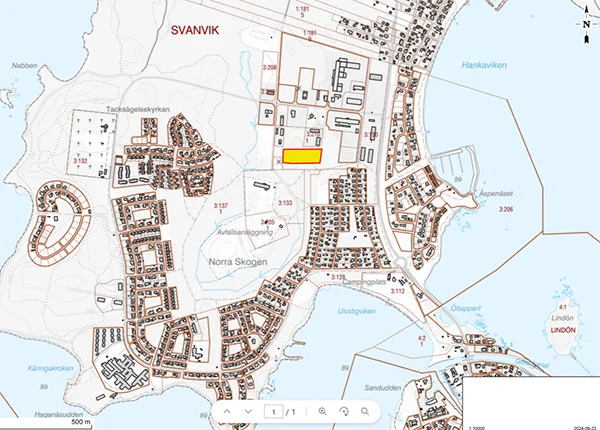

Handelsmannen 2

Denna site är lämpad för:

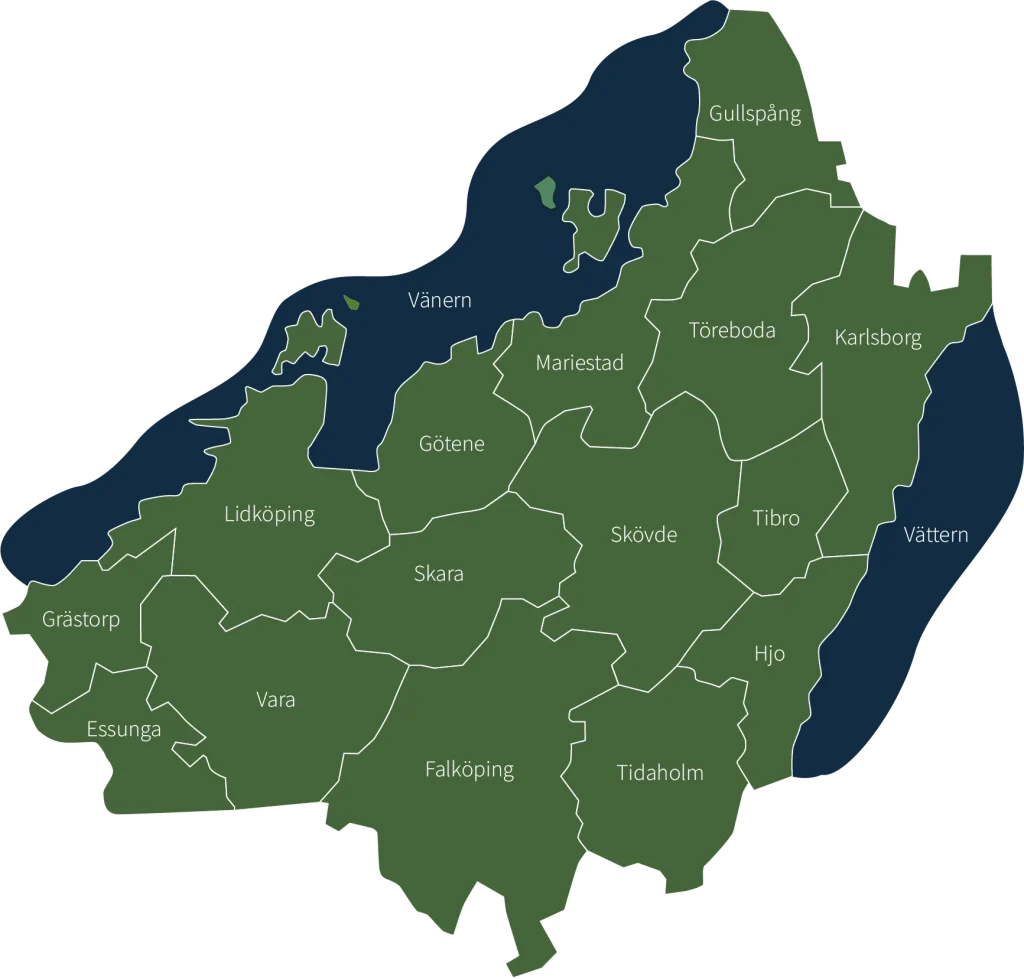

Karta över Skaraborgs siter

På kartan ser du alla siter som finns tillgängliga och vart i Skaraborg de ligger. Notera att placeringarna är ungefärliga.

Klicka på respektive site på kartan för att läsa mer.

Skaraborgs kommuner

Skaraborg är en delregion i Västra Götaland med drygt 270 000 invånare som har stora ambitioner att växa.

Välkommen att läsa mer om respektive kommuns näringsliv, utveckling och tillväxt.

Som regional partner till Business Sweden samarbetar vi även kring det nationella visningsverktyget Site Finder.

Site: Ving

Site: Suntak

Site: Stallaholmen

Site: Smuleberg

Site: Sikagården

Site: Rotkilen

Site: Ramstorp

Site: Mölltorp

Site: Munkagården

Site: Marbotorp

Site: Kartåsen

Site: Kantarellen

Site: Björnemossen

Site: Åsen

Site: Kvistborren 3

Site: Lövsågen 4

Site: Floby

Site: Bernstorp

Site: Balteryd

Site: Motorblocket

Etablera dig i Skaraborg

I Skaraborg finns du mitt ibland Sveriges och Nordens stora marknader med utmärkta logistikmöjligheter och modern infrastruktur. Marken vi förmedlar är kommunalt ägd detaljplanerad verksamhetsmark som är redo att bebyggas med framtidens industrier.

Välkommen att läsa mer om respektive kommuns näringsliv, utveckling och tillväxt.

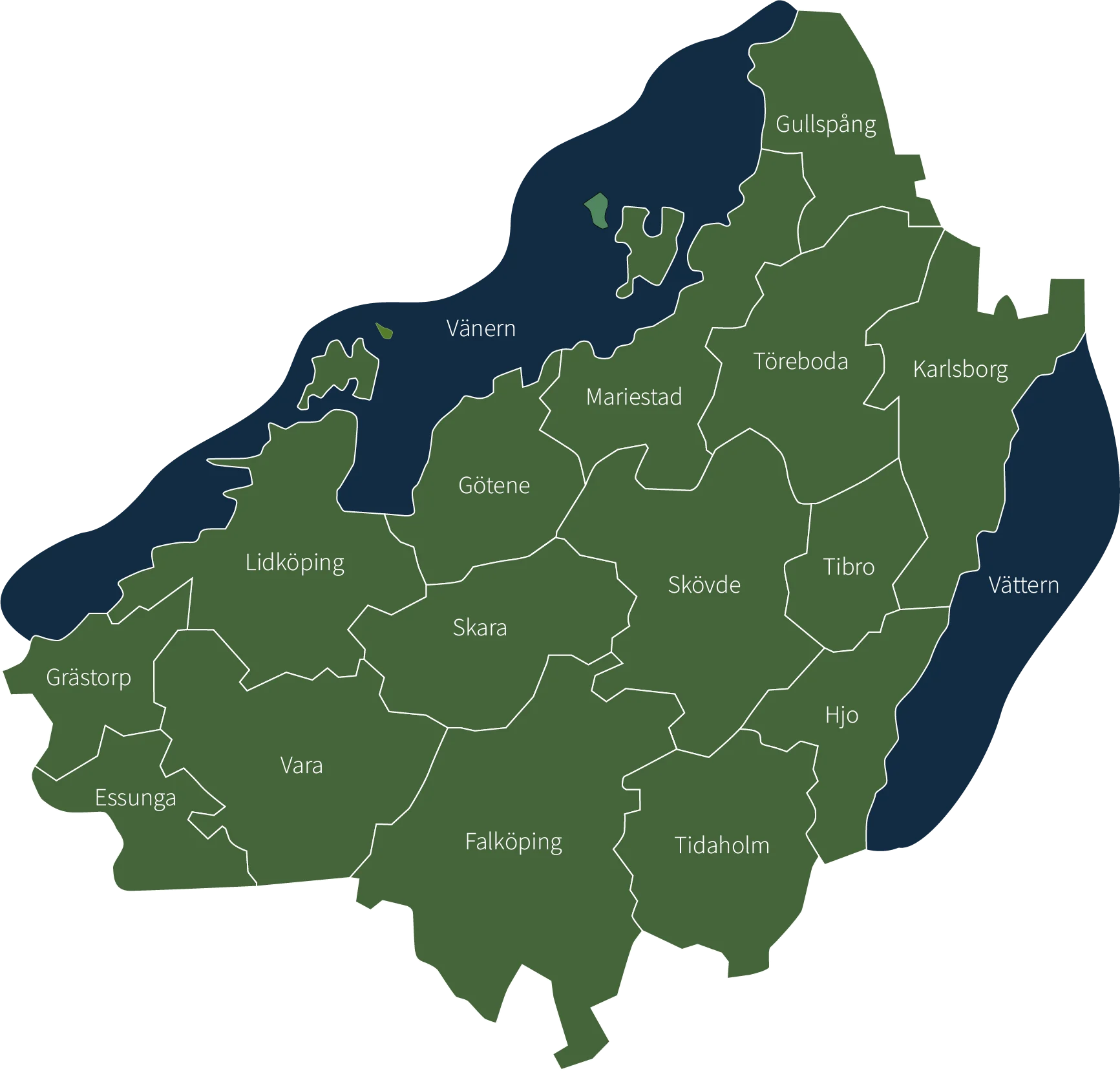

Alla kommuner i Skaraborg

Skaraborg är en delregion i Västra Götaland och har drygt 270 000 invånare som lever och verkar i någon av Skaraborgs 15 kommuner. Klicka på respektive kommun för att besöka deras webb.